Distributions & Charitable Beneficiary Designations

IRA Distribtuions / Retirement Assets / Insurance / Accounts

If you are concerned with potentially high estate taxes, the charitable beneficiary designation is a good choice because the benefit payment is generally excluded from your estate for tax purposes. And, because you may change the beneficiary designation at any time, your decision is revocable.

Qualified IRA Distributions

A great benefit to donors 70 1/2 and older! The Qualified Charitable Distribution is an excellent way to show your support for Pacific Battleship Center and receive tax benefits in return. As you plan your charitable giving for this year, consider using your IRA account to make the most of your charitable giving. You receive a tax benefit even if you take the standard deduction! It’s important to consider your tax situation before deciding whether to make a charitable contribution from your IRA. Be sure to share this gift plan with your financial advisor.

Potential Tax Benefits

- IRA Qualified Charitable Distributions are excluded as gross income for federal income tax purposes on your IRS Form 1040.

- The gift counts toward your required minimum distribution for the year in which you made the gift.

- You could avoid a higher tax bracket that might otherwise result from adding a required minimum distribution to your income.

Retirement Accounts

One of the most tax-efficient ways to give back to your community is by designating the Pacific Battleship Center as a beneficiary of your retirement plan, whether it is a 401(k), 403(b), IRA (individual retirement account), or other qualified retirement program. Estate taxes may be due in addition to the taxes your heirs may pay on the income in respect of the decedent (IRD). For these reasons, many advisors recommend retirement plan assets as the first to be designated for charitable purposes.

Potential Tax Benefits

- Avoid estate tax on retirement assets.

- Heirs would avoid income tax on any retirement assets funded on a pre-tax basis.

- Estate tax savings from an estate tax deduction.

Life Insurance

The gift of life insurance allows you to leverage relatively modest premium payments into a significant contribution towards the Pacific Battleship Center. To make a gift of life insurance, name the Pacific Battleship Center the beneficiary of all, or a portion, of the proceeds of your policy. Alternatively, you can name the Pacific Battleship Center as the contingent beneficiary of your policy or name a charitable remainder trust the beneficiary. Check with your tax professional for potential tax benefits which may include an immediate tax deduction and your ability to deduct future premium payments.

Other Accounts & Assets

You can name Pacific Battleship Center as a charitable beneficiary for a variety of accounts and assets including:

- Cash.

- Bank and investment accounts.

- Contact your financial advisory for additional options.

Additional Information

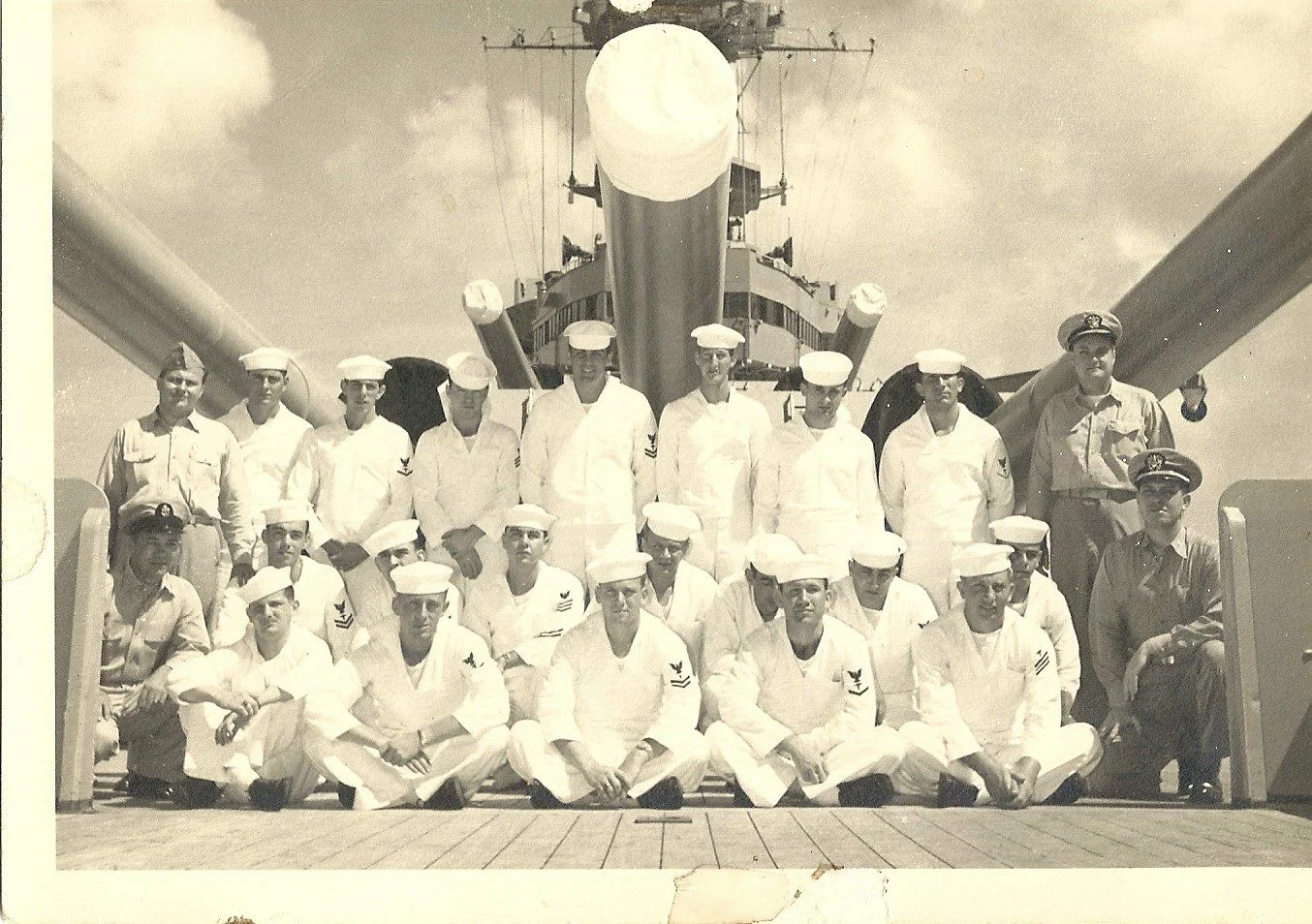

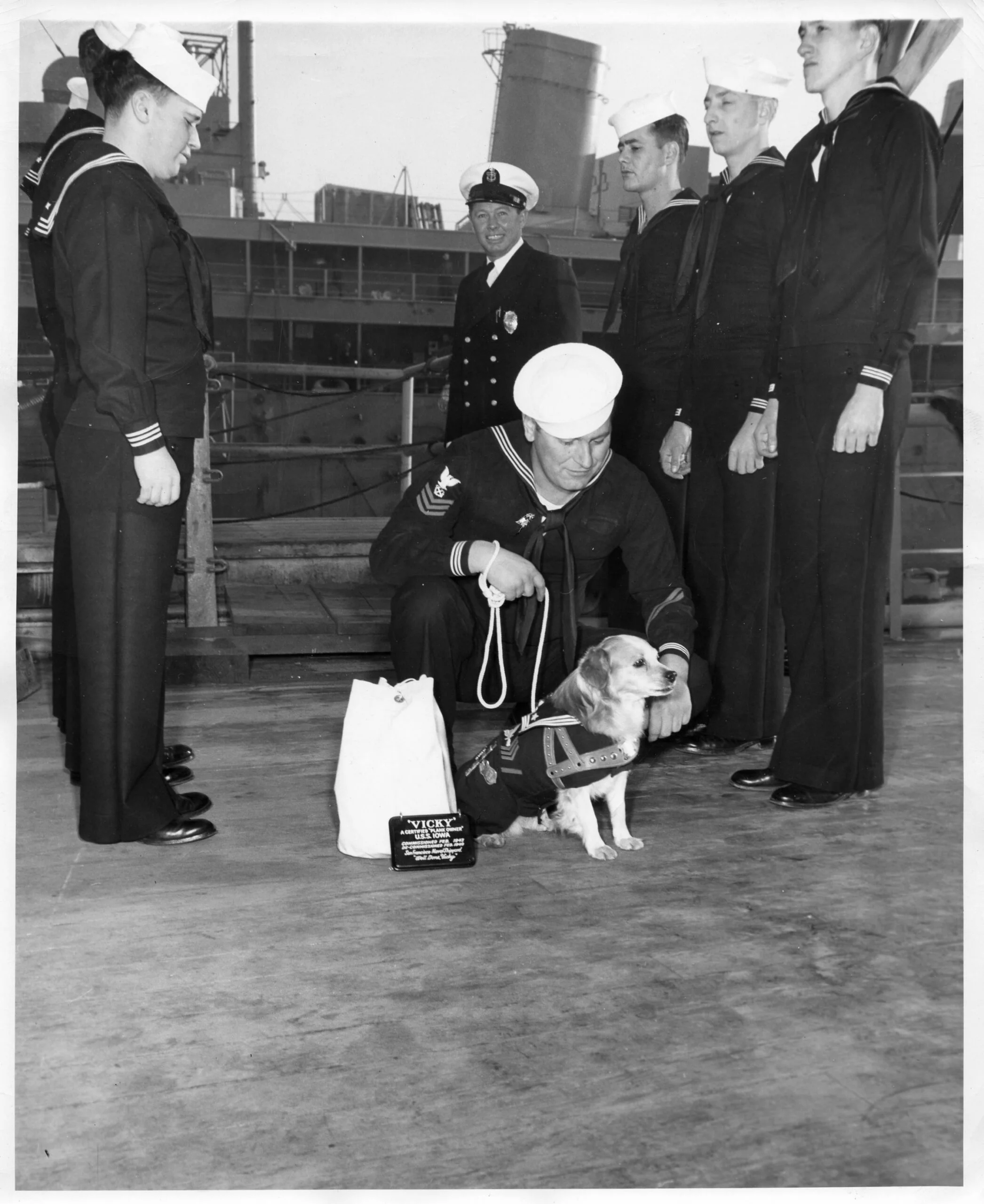

John Paul Jones Legacy Society Benefits

Reduce or Eliminate Taxes

Reduce or Avoid Probate Fees

Leave a Legacy

Receive Benefits Today

We're Here to Help!

- Have questions about the John Paul Jones Legacy Society.

- Interested in connecting with an advisor for further information.

Name Us As Your Beneficiary

Pacific Battleship Center

250 S. Harbor Blvd.

San Pedro, CA 90731

Phone: 877-446-9261

Email: development@labattleship.com

Contact: Jonathan Williams, President & CEO

501c3 Non-Profit Tax ID: 26-3934742

Inform us of your intent to particpate to receive benefits today including your exclusive John Paul Jones Legacy Society wall certificate, wallet card, challenge coin, and special invites to Legacy Society events.

Kyle Aube

Development Director

Phone: 877-446-9261 ext. 747

Email: kaube@surfacenavymuseum.org

* The content found on this site is general in nature and intended to be used for informational purposes only. It should not be relied upon as legal, tax, accounting or other professional advice. To determine how a gift or estate planning decision might affect your particular circumstances, it is expressly recommended that you consult an attorney, financial advisor or other qualified professional.

** Exclusive wall certificate, wallet card, and challenge coins are planned to be available in late 2022 or early 2023. In order to send these special mementos, we need to have a Commitment form on file.

Other Planned Giving Opportunities

Gifts That Cost You Nothing Now

Gifts That Reduce Your Taxes

- Outright gift of cash

- Stocks, bonds, and retirement assets

- Real estate

- Personal property

- Donate now

Gifts That Pay You Income

Gifts That Make An Impact Now

- Donor Advised Fund

- IRA Qualified Charitable Distribution

- Stocks, bonds, and securities

- Personal property

- Donate now